According to a recent report by Forrester, the global IT services market is poised to reach a staggering $2 trillion by 2028. This growth will be fueled by enterprises’ pursuit of IT modernization and digital transformation. Drawing insights from public financial disclosures, executive interviews, and extensive data analysis, the forecast sheds light on the evolving landscape of IT expenditure.

According to a recent report by Forrester, the global IT services market is poised to reach a staggering $2 trillion by 2028. This growth will be fueled by enterprises’ pursuit of IT modernization and digital transformation. Drawing insights from public financial disclosures, executive interviews, and extensive data analysis, the forecast sheds light on the evolving landscape of IT expenditure.

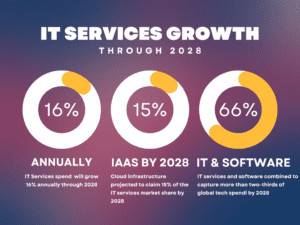

Despite encountering near-term hurdles such as economic uncertainties stemming from trade conflicts and geopolitical tensions, Forrester anticipates a robust annual growth rate averaging 16% through 2028. This bullish projection underscores the resilience of the IT services sector amid challenging macroeconomic conditions.

Leading the charge in this upward trajectory are hyperscale cloud providers such as Amazon AWS, Microsoft Azure, and Google Cloud, catalyzing substantial growth particularly in Infrastructure as a Service (IaaS). Forrester predicts a doubling of IaaS spending within the next five years, with public cloud infrastructure providers projected to claim 15% of the IT services market share by 2028, up from 8% in 2022.

The allure of cloud infrastructure extends beyond mere technological advancement; it serves as a gateway for enterprises towards consumption-based spending models, reshaping traditional procurement paradigms. As organizations increasingly embrace cloud data and compute services, the demand for specialized skills in data management, cybersecurity, AI, machine learning, and other data-related disciplines intensifies, creating a competitive talent landscape.

Forrester foresees substantial upticks in spending across advisory, implementation, and managed services domains, underlining the indispensable role of IT services companies in addressing skill shortages and facilitating technological transitions. With IT services and software projected to command over two-thirds of global tech spending by 2027, the convergence of these sectors heralds a transformative era in enterprise IT expenditure.

Accenture, a titan in the IT and management realm, anticipates significant dividends from the burgeoning field of generative AI. Having made substantial investments in AI development and workforce upskilling, the firm is well-positioned to capitalize on the burgeoning demand for AI consulting services. As evidenced by Accenture’s robust new business acquisitions, the ascendancy of generative AI consulting signifies a pivotal growth frontier within the IT services landscape. However, other smaller and mid-size advisory practices are poised to take advantage of this expected wave of new spending on IT services.

Moreover, the proliferation of AI technologies holds promise for reshaping IT service delivery paradigms, ushering in automation, cost efficiencies, and enhanced resource allocation. As organizations pivot towards AI-driven solutions, the potential for streamlining processes and unlocking additional avenues for modernization looms large on the horizon.

In essence, the trajectory of IT services spending underscores a paradigm shift towards cloud-centric, AI-driven models, wherein enterprises navigate towards agility, innovation, and sustainable growth in an increasingly digital world.

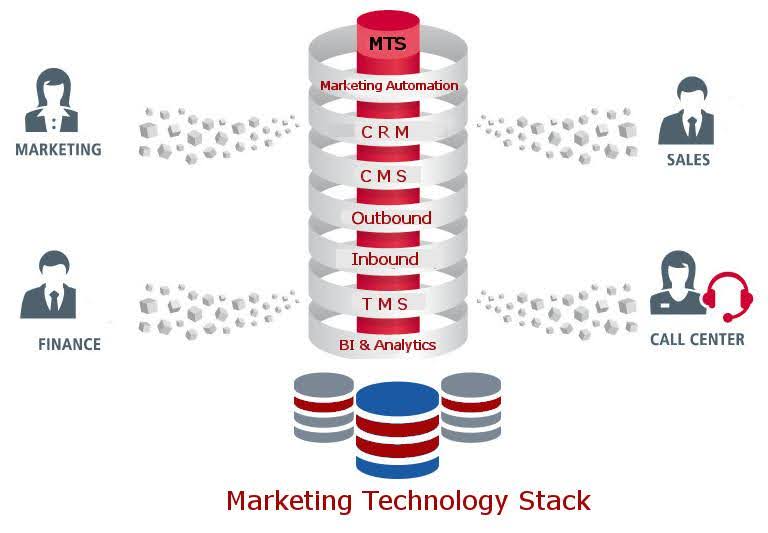

Here are some IT services that will truly benefit from this paradigm shift in IT spending:

- Cloud-centric services: Cloud Management, Cloud Migration, Cost Optimization, Software-as-a-Service

- AI-driven services: Generative AI; Machine Learning and MLOPs; Natural Language AI; Conversational AI

- Cloud Cybersecurity services: Cloud Security Architecture; Secure Access Service Edge (SASE); Web App and API Protection (WAAP); Cloud Workload Protection Platform (CWPP)

- Data Cloud services: Cloud Storage & Backups; Cloud based Master Data Management (CMDM); Cloud Data Visualization & Business Intelligence